lincoln ne sales tax increase

The Lincoln sales tax rate is. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

For tax rates in other cities see Nebraska sales taxes by city and county.

. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055. You can print a 725 sales tax table here.

It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and build four new.

The city took in 38965023 for the general. Esposito said theres a lot of support for the idea. The December 2020 total local sales tax rate was also 5500.

The current total local sales tax rate in Lincoln NE is 7250. Lincoln collects a 175 local sales tax the. The local sales and use tax rate in Chadron will increase from 15 to 2.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. Lincoln voters approved the 14-cent increase in April to support two important public safety projects. 025 lower than the maximum sales tax in NE.

Did South Dakota v. The Nebraska state sales and use tax rate is 55 055. Wayfair Inc affect Nebraska.

Lincolns City sales and use tax rate will increase from 15 to 175 on October 1 2015. The current total local sales tax rate in Lincoln County NE is 5500. Monday March 21 2022Edit.

Officials say Lincoln is growing and that the 19 million the wheel tax annually generates is not enough for future street needs which prompted the measure to be put on Tuesdays primary ballot. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. The Lincoln sales tax rate is.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. The Lincoln Sales Tax is collected by the merchant on all qualifying sales made within Lincoln. 800-742-7474 NE and IA.

Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. The Nebraska state sales and use tax rate is 55 055. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15.

Wayfair Inc affect Nebraska. In Lincoln the local sales and use tax rate will jump from 15 to 175. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent t o 175 percent beginning October 1. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1.

Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. Lincoln ne sales tax increase. The County sales tax rate is.

There is no applicable county tax or special tax. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The December 2020 total local sales tax rate was also 7250.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Learn all about Lincoln real estate tax. Sales tax permit holders need to prepare to collect sales tax at the new rate when this increase goes into effect this fall.

The Nebraska sales tax rate is currently. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. The official final results show 5065 percent of.

Groceries are exempt from the Lincoln and Nebraska state sales taxes. In a very close vote Lincolnites approved a quarter-cent city sales tax hike Tuesday that will add a penny to the cost of a 4 cup of coffee and bring in an estimated 13 million a year for. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1.

Replacement of the Citys emergency 911 radio system and the construction andor relocation of four. The Nebraska state sales and use tax rate is 55 055. 1 the Village of Orchard will start a 15 local sales and use tax.

It was a close vote but. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Lincoln Ne Sales Tax Rate 2018. Over the last three years the city of Lincoln has been able to repair and build more roads than normal thanks to voter approving a quarter-cent sales tax increase in 2019.

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

2020 Nebraska Property Tax Issues Agricultural Economics

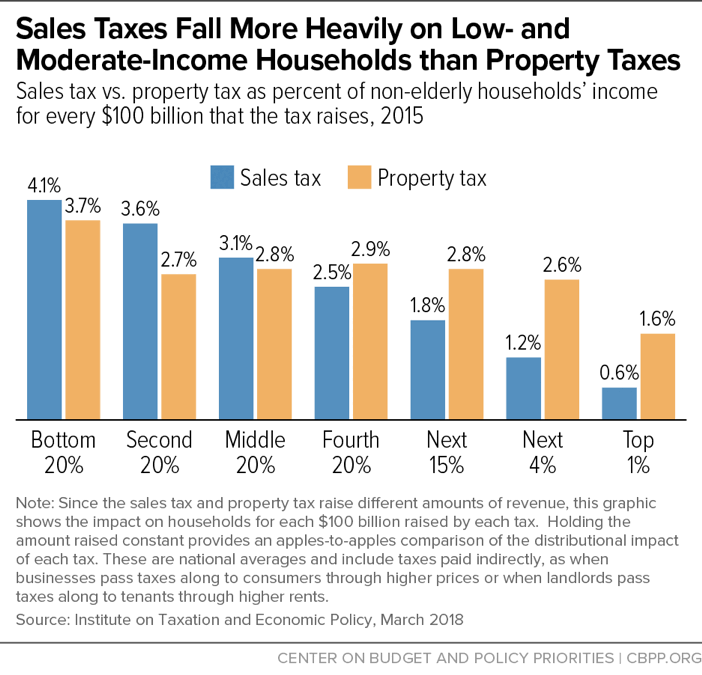

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Lotm Frequently Asked Questions City Of Lincoln Ne

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Nebraska Sales Tax Small Business Guide Truic

Nebraska Sales Tax Rates By City County 2022

General Fund Receipts Nebraska Department Of Revenue